AlphaNet User Guide

Getting Started with AlphaNet

Before trading on AlphaNet, you will need to connect your wallet - any wallet from commonly used L1s work. Your wallet address needs to be whitelisted - either via whitelist signup approval or being approved through an AlphaNet Guild.

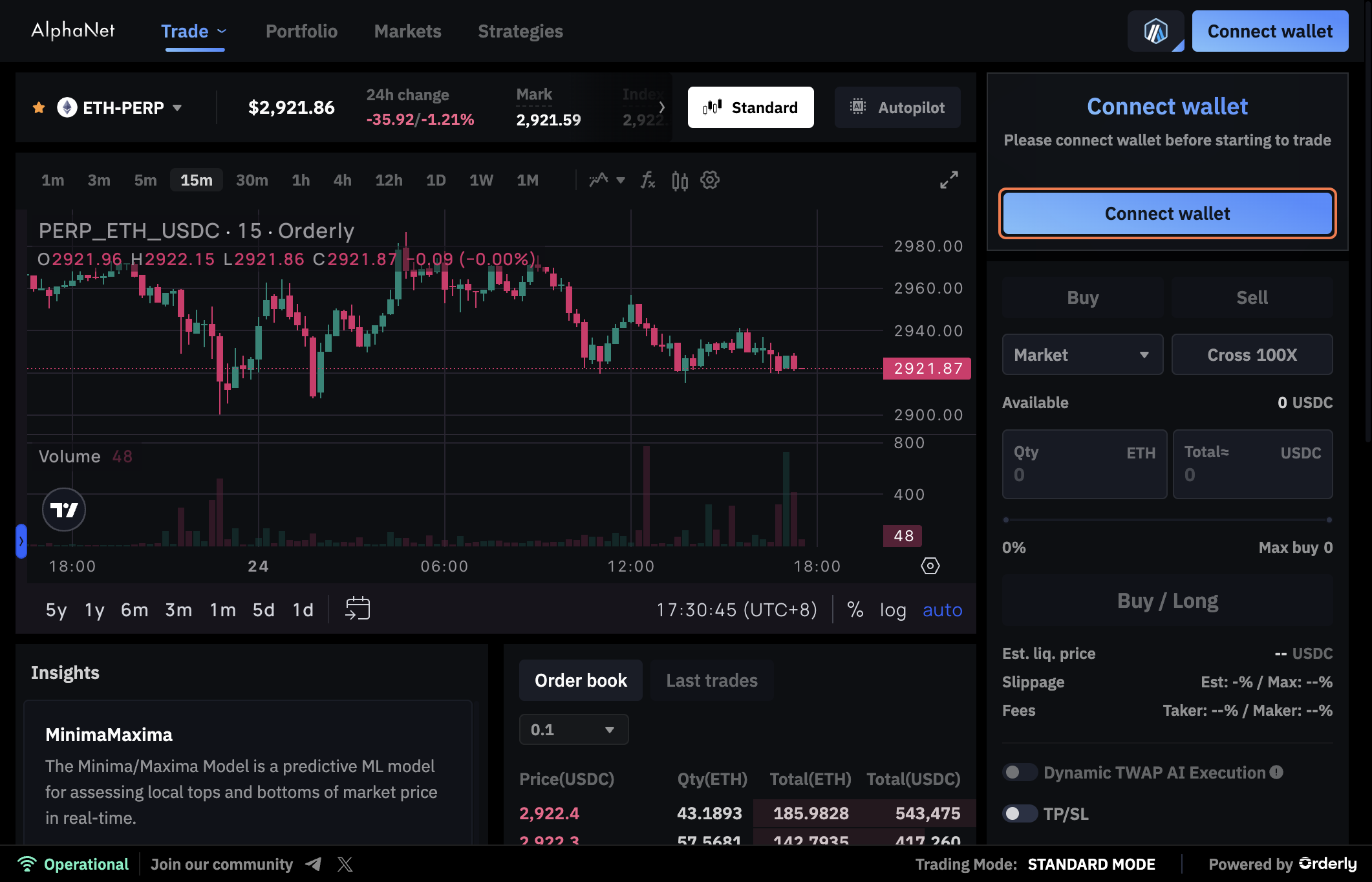

Click on Connect wallet.

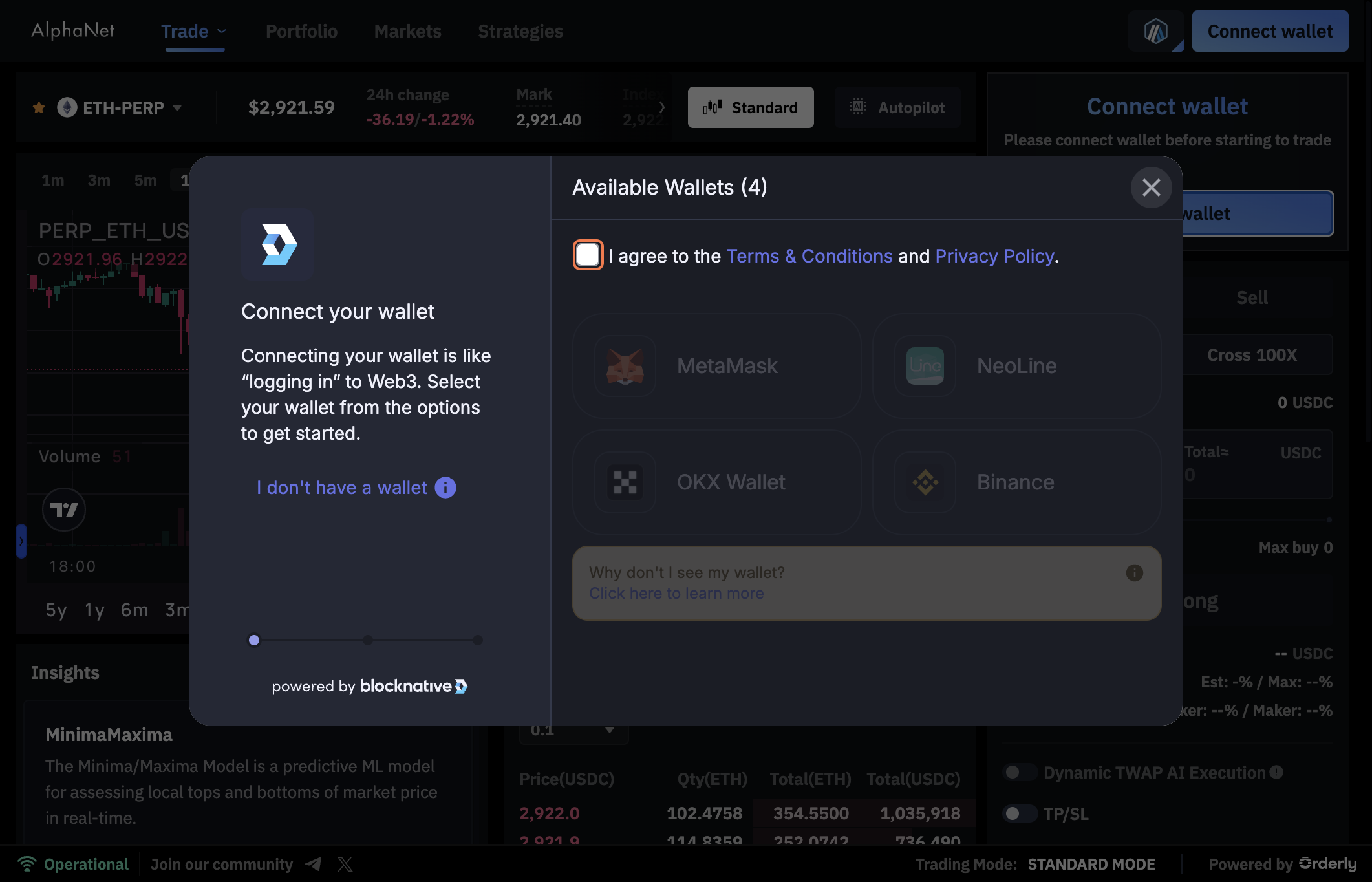

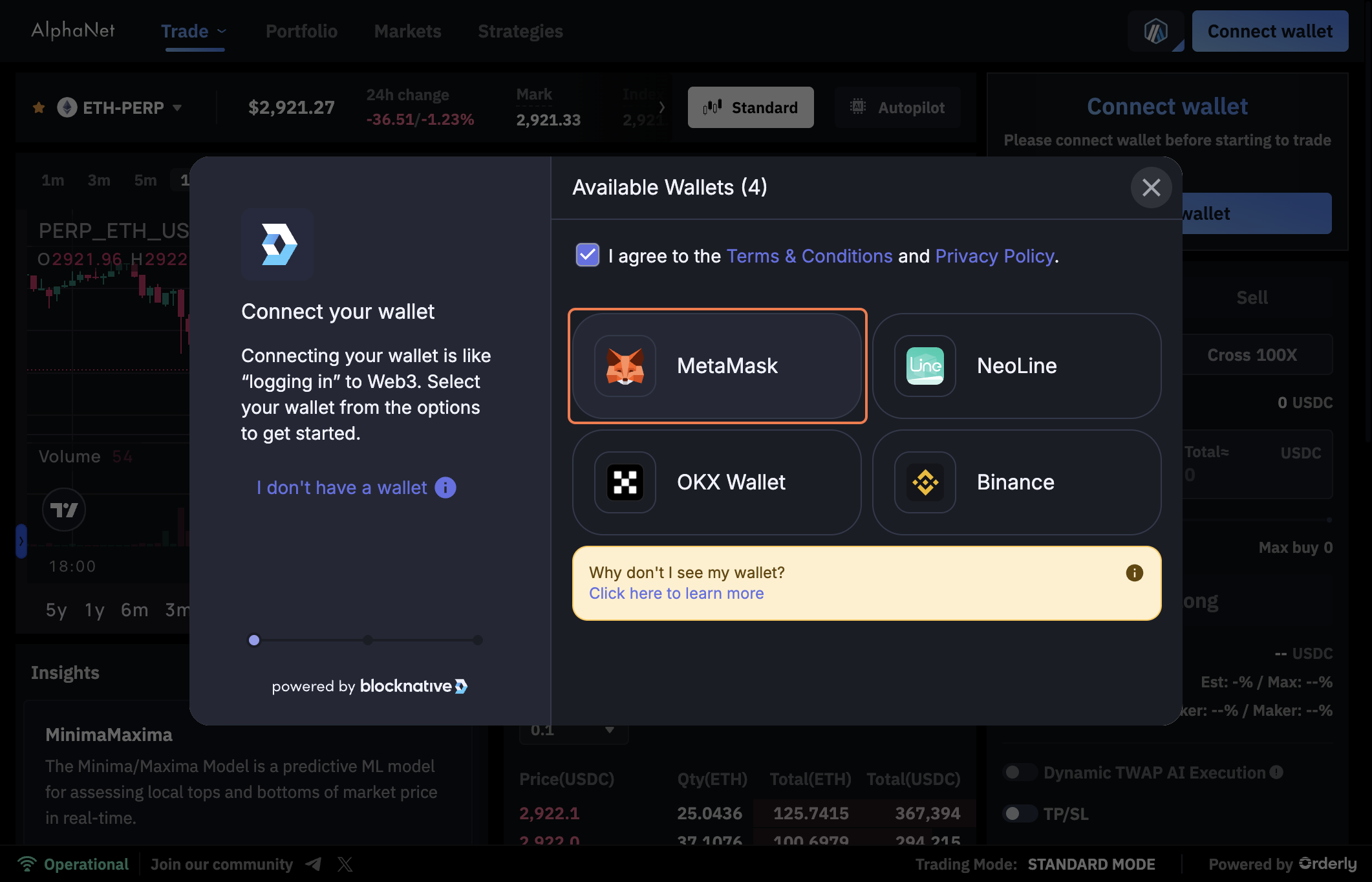

Check I agree to the Terms & Conditions and Privacy Policy.

Click on a wallet.

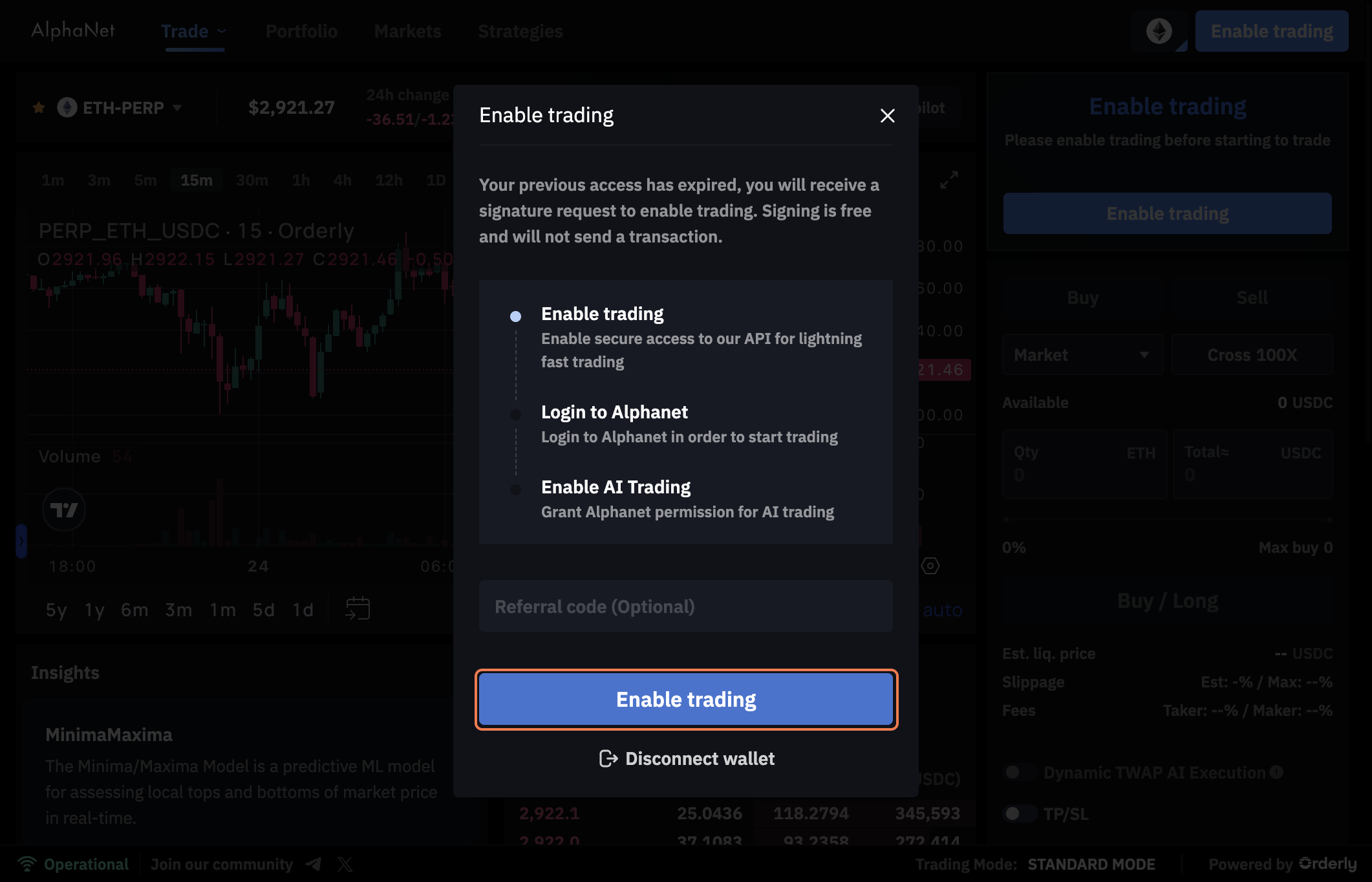

Click on Enable trading, then complete a series of signatures.

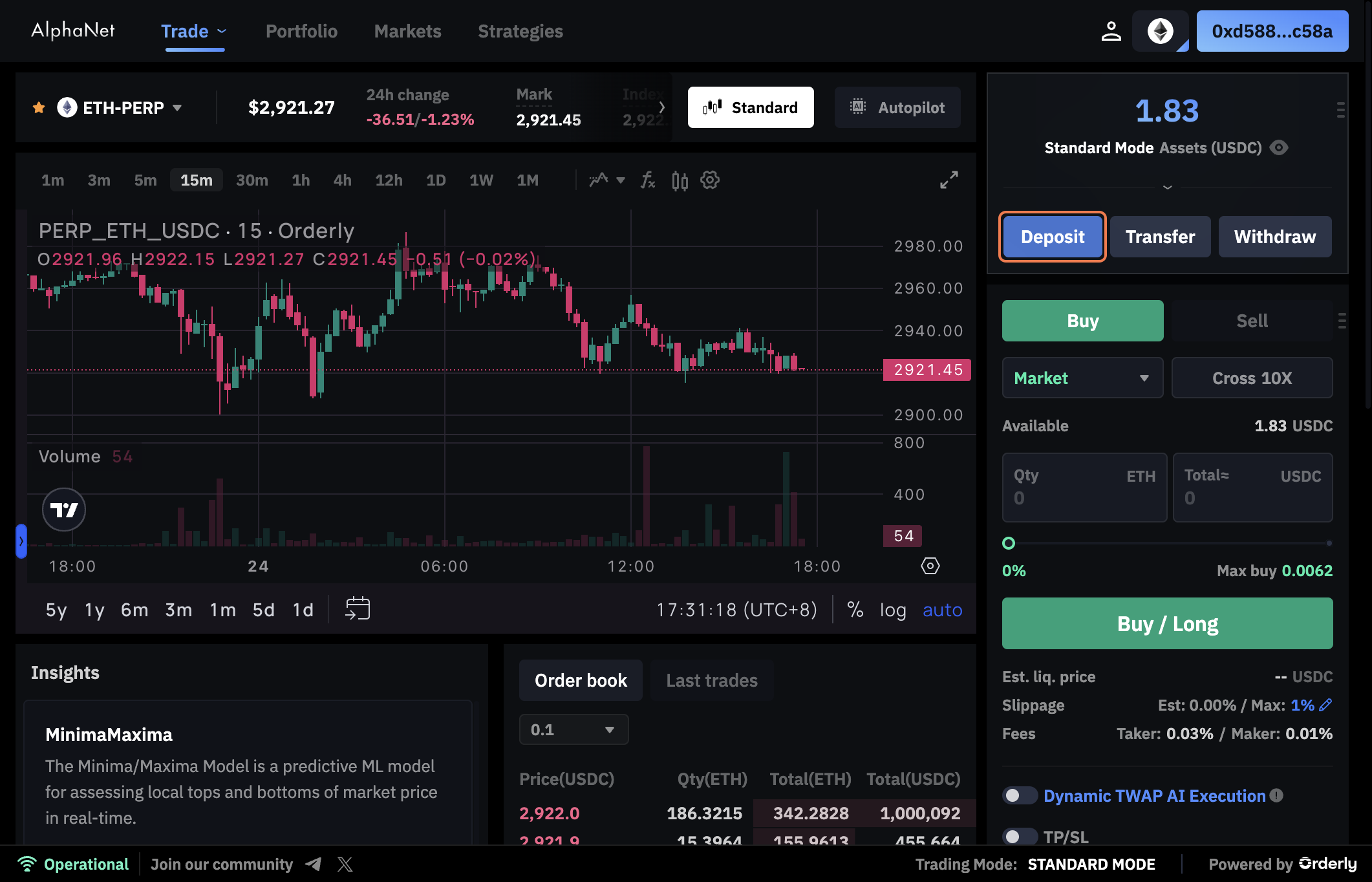

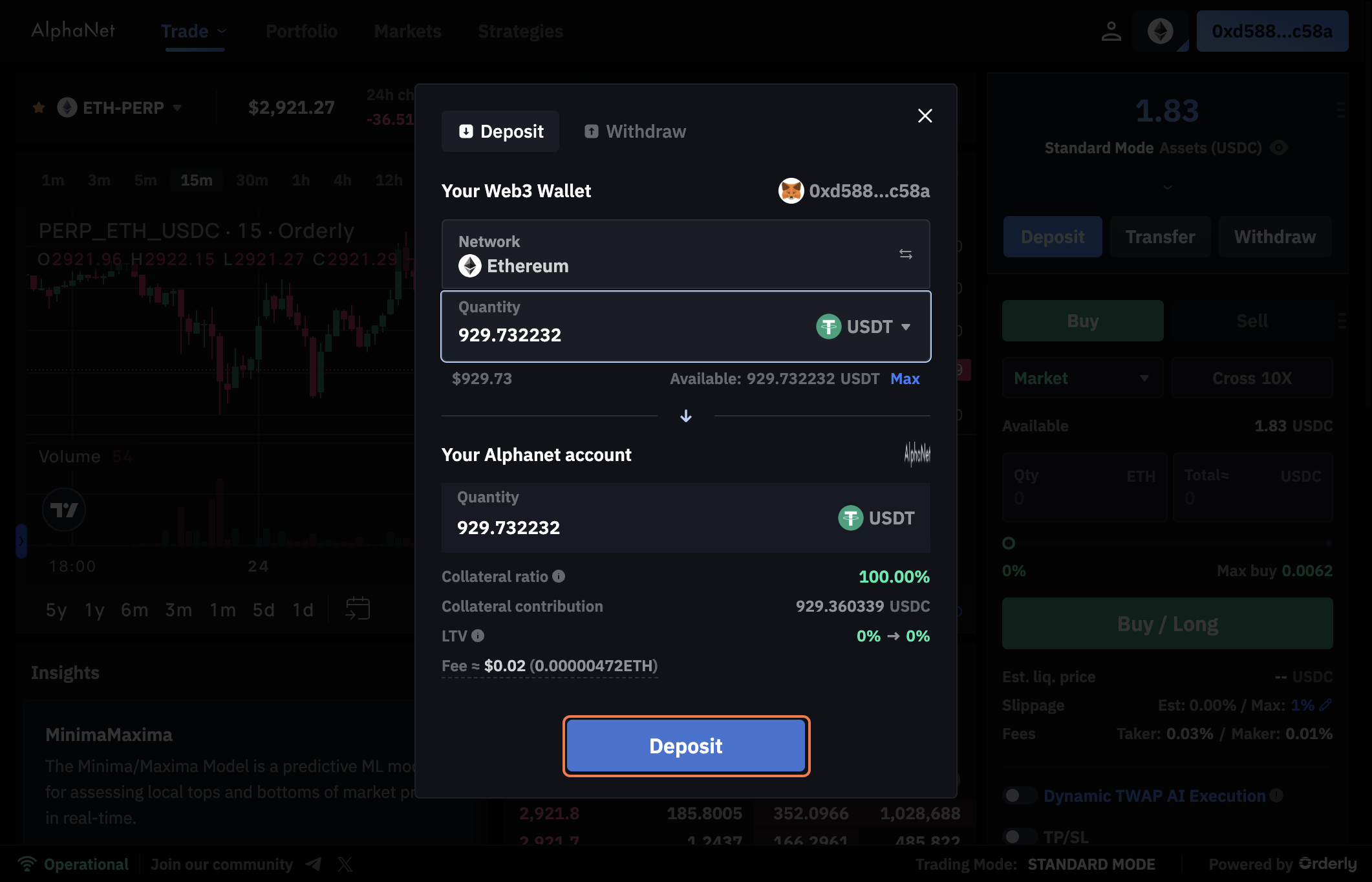

Click on Deposit.

Select the token, enter the amount, and then click Deposit. The deposited funds are expected to be credited within a few minutes to around 10 minutes.

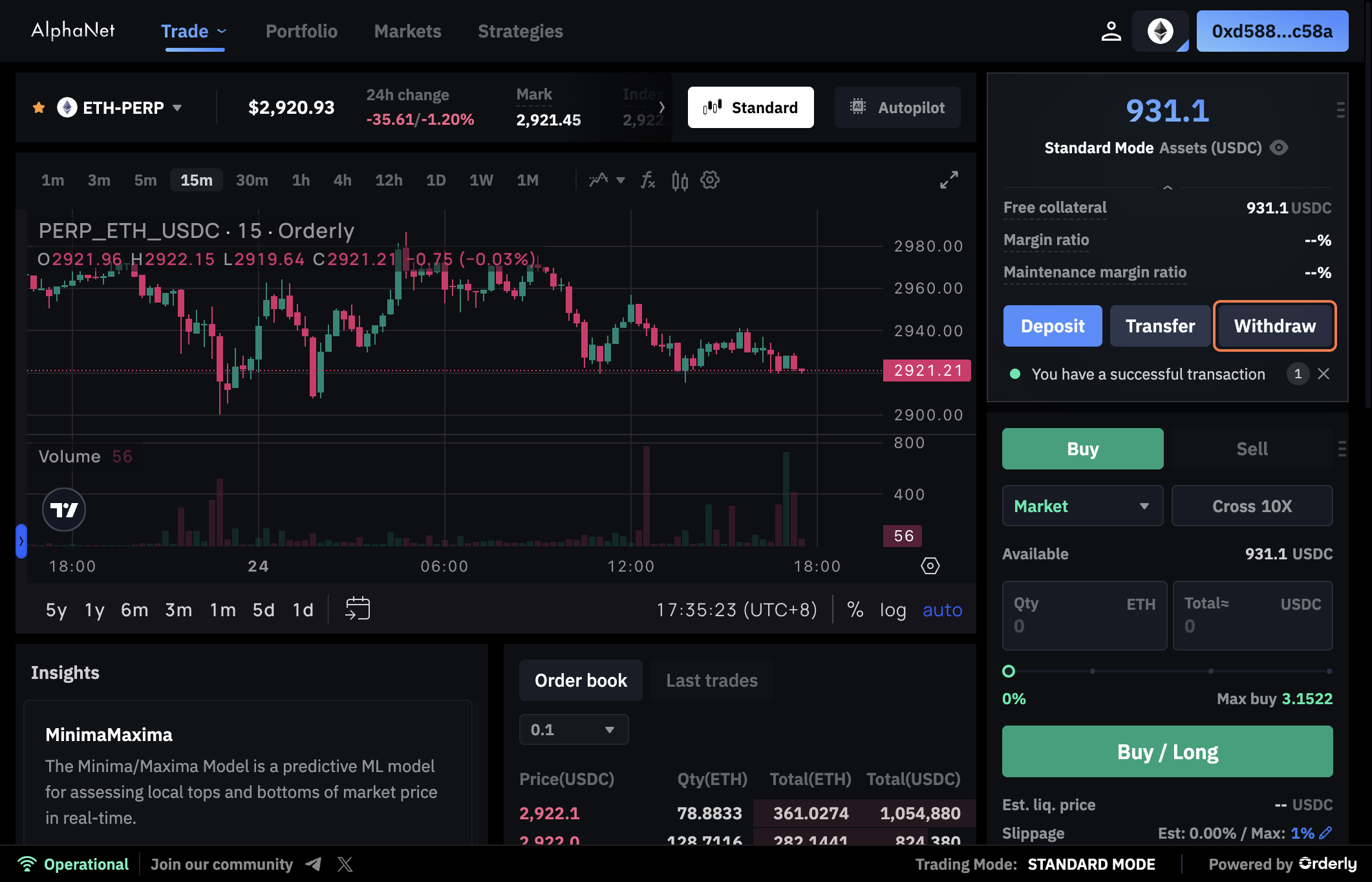

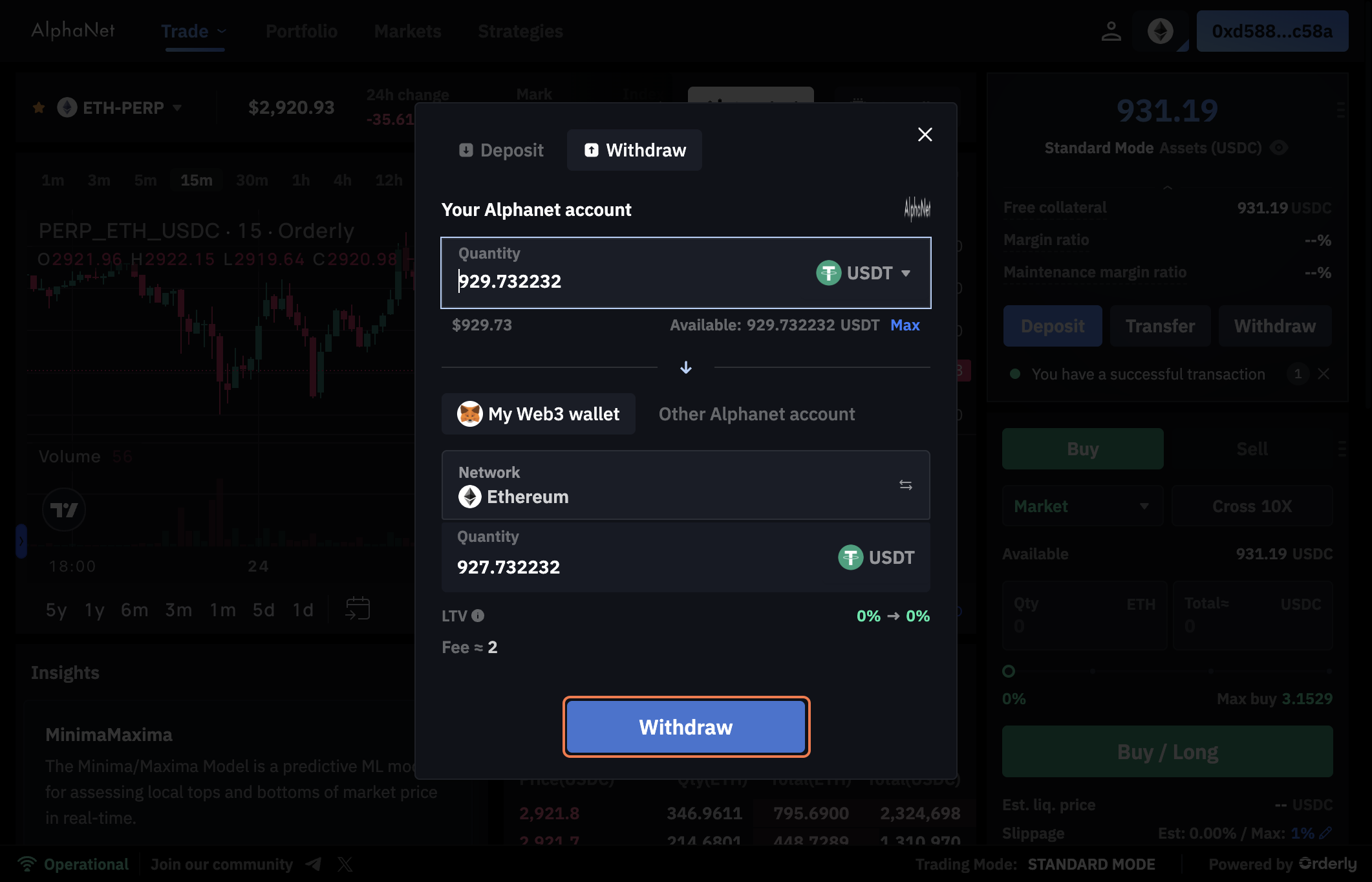

If you want to withdraw tokens, click Withdraw.

Select the token you deposited, enter the amount, and then click Withdraw.

AlphaNet Insight Models

WaveML

Directional Market Inefficiency Exploiter

WaveML is a novel quantitative machine learning model with one goal in mind – exploit directional market inefficiencies when volatility rises. In layman’s terms, you don’t want to make a short-timeframe directional bet or a scalp trade when it’s low volatility and price is barely drifting with low volume, but you also don’t want to trade volatile uncertainty, where you get whiplashed by noisy chop (worse case than low volatility). In the latter case you can easily get stoploss-ed multiple times.

Simply put, when we are scalping (especially leveraged) we want to ride on a "clean trend", not a chaotic choppy mess or a drifting flatline. This is much easier said than done, as short-timeframe markets move fast and have a high level of noise. This is where WaveML comes in – an institutional-grade ML model that defines these pockets of market inefficiencies, or opportunities, as "waves".

A "wave" is defined as a pocket (short time period) where directional strength is both strong and where "chaos" and market efficiency are low. (We put "chaos" in quotations as it’s a concept we use to demonstrate a point, not actually directly used in implementation or design of the model itself. We may use models that can represent or is related to "chaos" in some form)

During a "Wave ON" state, we are expecting:

Medium to high volatility, enough to produce immediate price action in minutes to hours ahead.

The price action to be clean, and low "chaos" or "entropy".

Once you determine direction (see below), you are able to make a scalp with at least 20-30bps of profit potential.

Effectively during a "wave ON" state, you should have an advanced edge in successfully executing a directional scalping trade, and confirming or predicting direction and a "clean" microtrend would become much easier than normal (hence "market inefficiency").

However, WaveML does not provide any price action directional guidance for you, but during "wave ON" states "smooth" directional moves are persist longer and more predictably than normal.

Usage Tips:

WaveML does not turn on often, but the accuracy rate in determining these "volatile" clean moves is high. In other words – the signal to noise ratio is high.

Here are some ways of determining price direction to utilize with WaveML

- Use your own directional indicators, models, or trend confirmation methods.

- Use with AlphaNet’s AgileTrend Insight Models, which predict short-timeframe trends.

- AlphaNet’s AgileTrend Insight Models, which predict short-timeframe trends.

Utilize with AlphaNet’s model Minima-Maxima to optimize for local minimum and maximum entry points

Utilize our AI algo execution (Dynamic TWAP) to minimize slippage and trading costs.

Release Notes:

This WaveML model is the next-gen version of the previous WaveML released in legacy AlphaNet. Underlying model and mechanism are completely different – the original was aimed to achieve similar results, but is not nearly as precise and insightful in identifying the "wave on" state.

Those interested in "AlphaNet lore" and are interested in seeing the original in action, see the following video tutorial: https://www.youtube.com/watch?v=A8c2oC5jSx0&t=36s

Minima-Maxima

Predicting Local Tops and Bottoms

Minima-Maxima is a versatile predictive ML model that uses order flow, market microstructure, and microtrends and mean-reversion to predict short-timeframe local minima and maxima in price action. Incredibly easy to use, and very powerful when used in the right context, Minima-Maxima can be used as both an enhancement of scalping trade edge as well as help enter into and exit from longer-timeframe trades at optimal price points.

Local minima [upwards yellow arrow] and maxima [downwards blue arrow] shown here

Usage Tips:

Utilize with AlphaNet’s AgileTrend-Fast or AgileTrend-Edge for enhanced directional scalping, depending on target timeframe.

Utilize with WaveML for market inefficiency exploints, but do not recommend using WaveML, AgileTrend, and Minima-Maxima simultaneously.

Minima-Maxima is not intended for use as a standalone scalping or trading strategy.

Use with our AI algo execution for even more enhanced entry and exits for both short timeframe and longer timeframe trades.

Release Notes:

- This is the next-gen upgrade of the original min-max in the legacy AlphaNet.

AgileTrend

Structural Microtrend Edge

AgileTrend is a proprietary predictive trend detection model that utilizes a novel ML model (non-open source) developed by AlphaNet’s technology partner Tensor Investment. AgileTrend aims to deliver accurate and fast-reacting classification of trend states across a variety of trading timeframes (micro, fast, medium, slow) and is designed for significant enhancement of directional trading and scalping edge.

All variations of the AgileTrend model classify the market in real-time into 3 distinct states: 1) uptrend, 2) downtrend, and 3) consolidation/chop. The trader is able to make real-time trading decisions with the assistance of this model, and can be combined with the other AlphaNet Insight models for maximum edge.

AgileTrend model in action, with blue signifying uptrend, red as downtrend, and grey as chop/consolidation/rangebound noise

chop/rangebound shown here in grey makes up majority of the market, for short timeframe scalpers, grey provides them clarity of when not to act or when to utilize a mean reversion scalping strategy

Usage Tips:

- Currently there are 2 variations of AgileTrend available: AgileTrend-Fast and AgileTrend-Edge. The former is the fast timeframe available and is much more sensitive than AgileTrend-Edge. Usage completely comes down to the individual trader’s trading style, preferences, or usage goals.

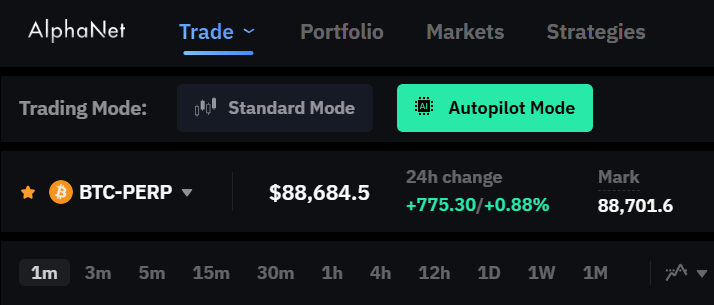

Trading Modes

AlphaNet provides users 2 modes of trading – Standard (manual with AI Insights and execution engine) and Autopilot mode. They are completely different ways of reaping the benefits of AlphaNet and users are able to leverage both at the same time:

Standard Mode – traders trade manually, utilizing their own approach and discretion, whilst being able to leverage AlphaNet’s AI Insight models to enhance their edge. Combine with our AI algo execution engine for slippage and cost minimization, as well as trade execution automation.

Autopilot Mode – completely automated trading, select from an arsenal of high Sharpe quantitative AI strategies and deploy with a click. Users have the ability to start and stop strategies at anytime - choose strategies by market profile and specs, and create their own "strategy of strategies".

To switch between modes, simply select "Trading Mode" on top left corner of screen and use the intuitive user interface

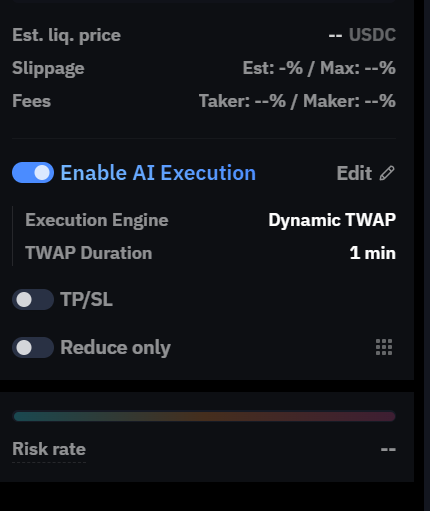

AI Algo Execution

Slippage and inefficient trading execution add up significant costs over time for traders, especially those that trade leveraged futures. AlphaNet’s AI algo execution engines are based on proprietary deep-learning frameworks that dynamically break up a trade into many smaller chunks for optimal execution and minimized slippage.

Our AI algo execution utilizes many factors for optimal execution, including price drift risk, directional price prediction, and liquidity – as an order plays out, the engine dynamically speeds up or slows execution to optimize for the end result (best execution price).

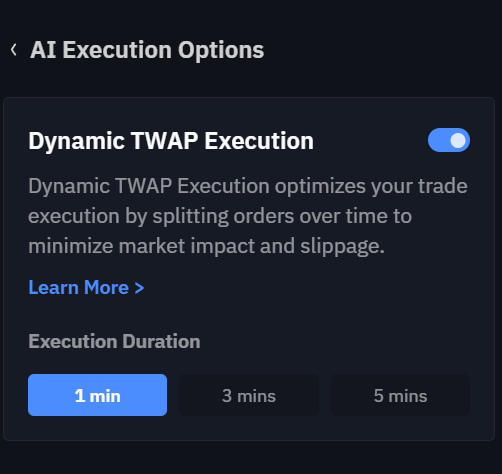

Currently, one version of this algorithm is available on AlphaNet – Dynamic TWAP. Dynamic TWAP is a deep learning-based algorithm that operates under a fixed time constraint and dynamically updates execution policy in real-time based on order size, orderbook, price, volume, and market conditions. Dynamic TWAP is perfect for scalping, short-timeframe trading, and trading strategies that are price risk and drift-sensitive. More variants of AI algo execution, including (maker-taker hybrid, and pure maker algo VWAP) will be added later on.

To utilize AI algo execution, simply go to the order section (right hand side of UI), and click on “Enable AI Execution”, set time constraint parameters, and the algo will do the heavy lifting for the user.

Select "Enable AI Execution"

Edit main parameter - time constraints

Once an order has been started, monitor the order execution progress under the "AI Orders" tab of order and trade history section.